Page 10 - The Indian EYE 090123

P. 10

OPINION SEPTEMBER 01, 2023 | The Indian Eye 10

India’s Pursuit of Rupee as a

Reserve Currency Status

SNEHA M

or decades, the US dollar has

solidified its position as the

Fworld’s leading reserve cur-

rency due to its wide acceptance in

almost all international trade trans-

actions. However, due to sanctions

and the rise of alternate reserve cur-

rencies, the US dollar’s importance

in world affairs is increasingly under

threat. Fast-growing economies like

China, India and others are proac-

tively tapping the benefits of trading

in national currencies.

Many countries have periodi-

cally considered the use of their na-

tional currencies through a range

of accords, such as currency swap

agreements and bilateral trade set-

tlement agreements. China’s renmin-

bi share in the global reserve curren-

cy rose when the Chinese leadership

institutionalized multinational finan-

cial infrastructure to settle transac- Courtesy: IDSA

tions in renminbi. China initiated a

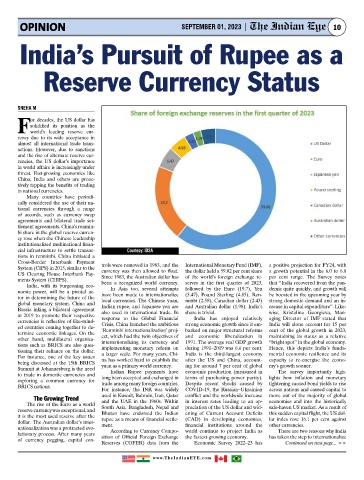

Cross-Border Interbank Payment trols were removed in 1983, and the International Monetary Fund (IMF), a positive projection for FY24, with

System (CIPS) in 2015, similar to the currency was then allowed to float. the dollar held a 59.02 per cent share a growth potential in the 6.0 to 6.8

US Clearing House Interbank Pay- Since 1983, the Australian dollar has of the world’s foreign exchange re- per cent range. The Survey notes

ments System (CHIPS). been a recognized world currency. serves in the first quarter of 2023, that “India recovered from the pan-

India, with its burgeoning eco-

In Asia too, several attempts

nomic power, will be a pivotal ac- have been made to internationalize followed by the Euro (19.7), Yen demic quite quickly, and growth will

be boosted in the upcoming year by

(5.47), Pound Sterling (4.85), Ren-

tor in determining the future of the local currencies. The Chinese yuan, minbi (2.58), Canadian dollar (2.43) strong domestic demand and an in-

global monetary system. China and Indian rupee, and Japanese yen are and Australian dollar (1.98). India’s crease in capital expenditure”. Like-

Russia inking a bilateral agreement also used in international trade. In share is trivial. wise, Kristalina Georgieva, Man-

in 2019 to promote their respective response to the Global Financial India has enjoyed relatively aging Director of IMF stated that

currencies is reflective of like-mind- Crisis, China launched the ambitious strong economic growth since it em- India will alone account for 15 per

ed countries coming together to de- ‘Renminbi internationalization’ proj- barked on major structural reforms cent of the global growth in 2023,

termine economic linkages. On the ect, which had the twin objectives of and economic liberalization in maintaining its status as a relative

other hand, multilateral organiza- internationalizing its currency and 1991. The average real GDP growth “bright spot” in the global economy.

tions such as BRICS are also ques- implementing monetary reform on during 1991–2019 was 6.6 per cent. Hence, this depicts India’s funda-

tioning their reliance on the dollar. a larger scale. For many years, Chi- India is the third-largest economy mental economic resilience and its

For instance, one of the key issues na has worked hard to establish the after the US and China, account- capacity to re-energise the econo-

being discussed at the 15th BRICS yuan as a primary world currency. ing for around 7 per cent of global my’s growth sooner.

Summit at Johannesburg is the need Indian Rupee payments have economic production (measured in The survey importantly high-

to trade in domestic currencies and long been accepted and exchanged in terms of purchasing power parity). lights how inflation and monetary

exploring a common currency for trade among many foreign countries. Despite recent shocks caused by tightening caused bond yields to rise

BRICS nations.

For instance, the INR was widely COVID-19, the Russian–Ukrainian across nations and caused capital to

The Growing Trend used in Kuwait, Bahrain, Iran, Qatar conflict and the worldwide increase move out of the majority of global

The rise of the Euro as a world and the UAE in the 1960s. Within in interest rates leading to an ap- economies and into the historically

reserve currency was exceptional, and South Asia, Bangladesh, Nepal and preciation of the US dollar and wid- safe-haven US market. As a result of

Bhutan have endorsed the Indian

this sudden capital flight, the US dol-

ening of Current Account Deficits

it is the most used reserve after the rupee as a means of financial settle- (CAD) in developing economies, lar index rose 16.1 per cent against

dollar. The Australian dollar’s inter- ment. financial institutions around the other currencies.

nationalization was a protracted evo- According to Currency Compo- world continue to project India as There are two reasons why India

lutionary process. After many years sition of Official Foreign Exchange the fastest-growing economy. has taken the step to internationalize

of currency pegging, capital con-

Reserves (COFER) data from the Economic Survey 2022–23 has Continued on next page... >>

www.TheIndianEYE.com